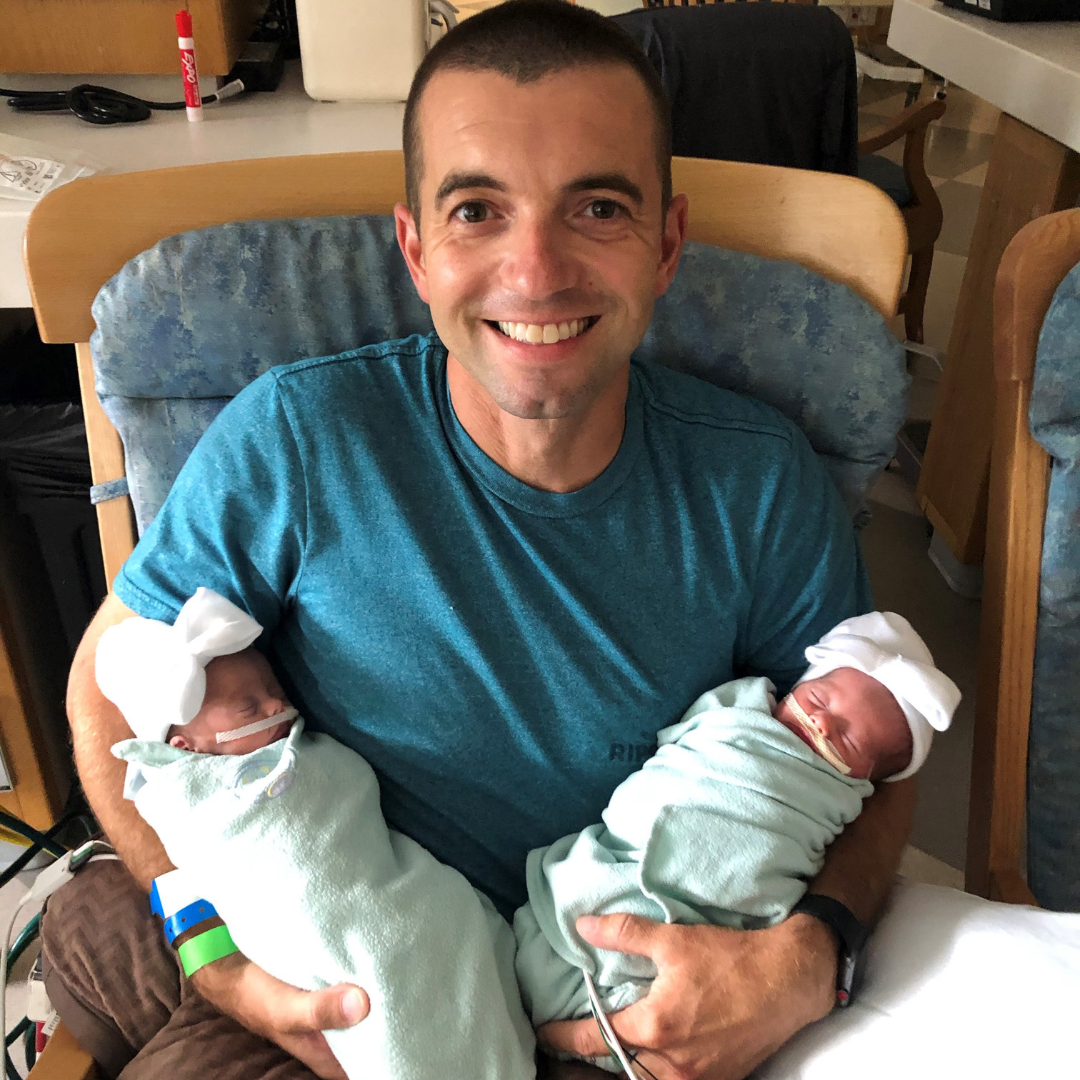

Make a Lasting Difference.

With a little planning and a big heart, you can provide a home away from home for sick or injured children and their families for years to come! No matter how you decide to create a legacy, we can help you find a charitable plan that meets your financial and philanthropic goals. Join our Legacy of Love Society, and together, we can keep children and families close to one another and the life-saving medical care they need for generations to come.

Ways to Create a Legacy of Love

Gift in Your Will or Trust |

Retirement Plan Assets |

Charitable Gift Annuities |

Charitable Remainder Gifts |

Life Insurance |

Interested in Creating a Legacy of Love?

We understand that the decision to leave a gift through your will or estate plan is a personal, important one. For questions or more information on planned giving options, please contact Susan Skolnick, Chief Development Officer, at susan@rmhck.org or 502.371.1444.

If you have included RMHCK in your plans, please let us know so we can honor your legacy.

Legacy of Love Society Members

Anonymous (11)

Bella Coleman

Jef Conner

Joanne Cralle*

Fallon Crowley

Sandie Davis

Alexis Doepp

Greg and Laurie Eichhorst

Diane Gillespie

Craig and Cis Gruebbel

Norma JoNell Hardison*

Rick and Terie Harper

Alan and Kelsey Keating

Lillian Abell Kidwell*

Leslie Masterson

Teresa Morales

Gwynyth S. Morgan*

Jessica Pelc

Royce and Michele Raleigh

Jim and Jane Ramsey

Anne E. Shapira*

Jewell Ann Shoemaker

Joyce Slusher*

Daniel and Carrie Stone

Mary Lou Trautwein-Lamkin*

Vince and Tracey Van Nevel

Alana Wilson

*Deceased

Frequently Asked Questions

Why Planned Giving?

- It’s easy. Helping families can be as simple as adding a sentence to your existing will or adding Ronald McDonald House Charities of Kentuckiana, Inc. on a beneficiary form.

- You have flexibility. Your gift can be a percentage, so it remains proportionate to other desires you wish to fulfill. It can also come to our House only after your other needs are met.

- You have options. Your gift can be unrestricted, or you can choose to help fund a specific program.

- You may realize tax benefits. Gifts of appreciated stock also help avoid capital gains and are accepted by RMHCK.

- Every gift will have a profound impact.

Do I need a will?

A will is important for everyone and can be useful regardless of estate size. It’s a way to support the people and causes important to you. Having a will ensures that your wishes are known, saving your loved ones the stress and cost of intestate probate proceedings.

How do I create a will?

RMHCK has partnered with FreeWill to give you an intuitive online resource that helps you write a legally valid will online. This free resource can help you create your legacy in 20 minutes, ensuring the peace of mind that comes with having a plan for you and your loved ones. Just go to FreeWill to get started.

Do I need to have an estate in order to leave a gift?

An estate is simply a word used to describe any property, money, or personal belongings that you may have at the time of your death. Most people leave an estate when they die, even though they may not have a great deal of wealth. Anyone can arrange to leave a charitable gift from their estate when they pass away.

Do I need to tell you that I’ve arranged for the gift?

This is up to you. We like to know in advance so we can recognize your generosity. We also can help you direct your gift to a specific program that fits your intentions. Ultimately, it is entirely up to you as to whether or not you let us know of your decision to leave a gift. If you would like to let us know that you’ve added RMHCK as a beneficiary in your will, you can self-report here or contact our Chief Development Officer.

What information do I need to provide to my attorney/advisor?

Bequests and other forms of planned/estate gifts should be designated to:

Ronald McDonald House Charities of Kentuckiana, Inc.

The information that you or your broker may need includes:

Legal Address: 550 S. First Street, Louisville, KY 40202

Intended Use of Gift: Please indicate whether the gift is intended for general purposes and uses or for a specific program. Please contact us in advance if there is a specific or restricted use for the gift to make sure that we can fully honor the donor’s wishes.

Sample Bequest Language: “I give, devise and bequeath the sum of $______ (or describe the percentage of the estate or specific asset/type of property you wish to give) to Ronald McDonald House Charities of Kentuckiana, Inc., whose legal address is 550 S. First Street, Louisville, KY 40202, for its unrestricted general use and purposes.”

Tax Identification Number: 31-1053467

To make a stock gift, contact Shelley Meredith.